The volatility of the won, coupled with the U.S. central bank’s move to

taper its stimulus measures is sending alarm singals to Korean

policymakers and currency authorities.

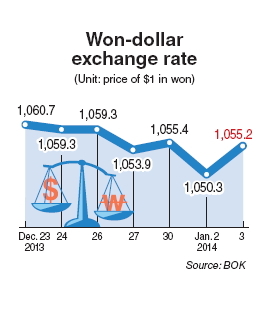

The U.S. dollar closed at 1,050.30 won on Thursday, the greenback’s cheapest position against the won in more than two years.

But it weakened to 1,055.20 won at Friday’s close, up 4.90 won from a trading session earlier.

The rise of the won against major currencies resulted in a tumble in the Korean stock market.

The

benchmark Korea Composite Stock Price Index finished last week at a

four-month low at 1,946.14, down 2.1 percent from a week earlier, as

market heavyweights such as Samsung Electronics lost ground in part

because of fears that the won’s strength would hurt its profits.

The

world’s No.1 mobile phone maker’s market value dropped by nearly $9

billion last week when its shares closed 4.6 percent lower Thursday at

1.31 million won. It recorded a further 1 percent drop to 1.29 million

won Friday.

댓글